In this IC Markets Review, I share with you information and details about IC Markets Broker, and I will also reveal if IC Markets is legit and regulated and if it is a good broker for you to trade with.

Read on to find out more.

About IC Markets

At a Glance

| Broker | IC Markets |

| Based in | Sydney, Australia |

| Other Locations | Cyprus, Seychelles |

| Operating Platforms | MT4, MT5, and CTRADER |

| Account Types | Standard Account and Raw Spread Account |

| Live Account | Open with a minimum of $200 |

| Regulated by | ASIC, CySEC, FSA |

| Trading Styles | All types of trading are allowed including: Scalping, EAs (Expert Advisors or trading robots). |

| Leverage | Up to 1:500 |

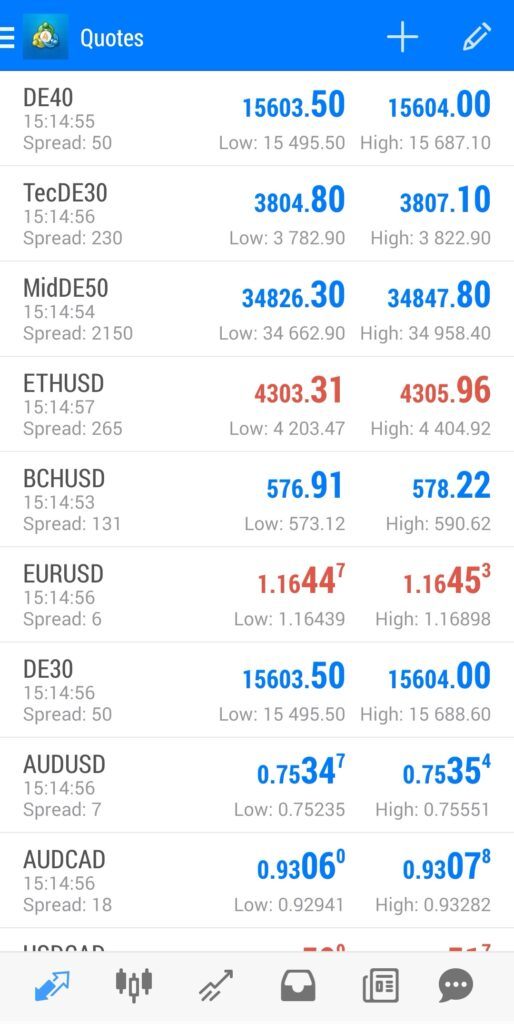

| Markets | Forex CFD, Incices CFD, Commodities CFD, Stocks CFD, Futures CFD, Bonds CFD, Crypto CFD Over 60+ currencies & 10+ cryptocurrencies |

| Operated on | PC, Tablet, Android, IOS |

| Prohibited countries | USA, Canada, Japan, New Zealand, Iran, Israel |

Disclosure: This post contains affiliate links. For more information please see my disclosure here

IC Markets is an Australian-based online forex broker that operates from Australia, Cyprus, and Seychelles.

IC Markets is the largest CFD broker in Australia and one of the largest Forex CFD providers.

The founder and CEO of IC Markets is the entrepreneur Andrew Budzinski.

IC Markets do not have their own trading platform. IC Markets can be connected to 3 different trading platforms; MetaTrader 4 (MT4), MetaTrader 5 (MT5) & CTrader. The preferred and most commonly used is MT4.

Is IC Markets Regulated

IC Markets is regulated by

- ASIC Act (Australian Securities and Investments Commission)

- CySEC (Cyprus Securities and Exchange Commission)

- FSA (Financial Services Authority) Seychelles

IC Markets holds the capital (clients’ money) in trust accounts with top-tier banks in Australia.

So, in answer to your question – Yes, IC Markets is legit and a regulated broker. Your money is safe with IC Markets.

Risk Warning: Trading Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

What Type of Broker is IC Markets

IC Markets is a forex and CFD broker.

IC Markets has selected popular products from different markets all over the world so you are able to trade the best opportunities 24/7.

You can trade the following CFDs;

- Forex CFD

- Indices CFD

- Commodities CFD

- Stocks CFD

- Futures CFD

- Bonds CFD, and even

- Crypto CFD

What are CFDs or Contracts for Difference

CFDs are contracts for difference, and as a trader, you are able to select from a large selection of financial instruments listed above, and trade (long or short) in real market conditions, without the necessity of actually owning that particular instrument in your account.

CFD trading is recommended for experienced or qualified traders. If you are a beginner, it is advisable to do some prior training.

IC Markets has a free demo account that you can start with, as well as FREE training tutorials (see below).

What Account Types Does IC Markets Offer

IC Markets has two types of accounts, Standard Account and Raw Spread Account.

| Standard Account | Raw Spread Account |

|---|---|

| Raw Pricing | Raw Pricing |

| Commission Free, Higher spreads 0.6 pips | Commission 3.5USD /lot. Lowest Spreads from 0.0 pips (EURUSD 0.1 pip spread) |

| Fast Order Execution | Fast Order Execution |

| 1:500 Leverage | 1:500 Leverage |

| MetaTrader 4 & MetaTrader 5 | MetaTrader 4 & MetaTrader 5 |

| Deep Liquidity | Deep Liquidity |

| Starting deposit: 200$ | Starting deposit: 200$ |

| Leverage 1:500 | Leverage 1:500 |

| Server location: New York | Server location: New York |

How to Open an Account with IC Markets

Signing up for a Demo or Live account is one easy process.

How to Open a Demo Account with IC Markets

To open a demo account you simply enter your name, email, and telephone number, and you are done.

How to Open a Live Account with IC Markets

To open a live account, you need to fill in a form with personal details, configure your trading account, answer a few questions related to trading, verify your identity, fund the account, and start trading.

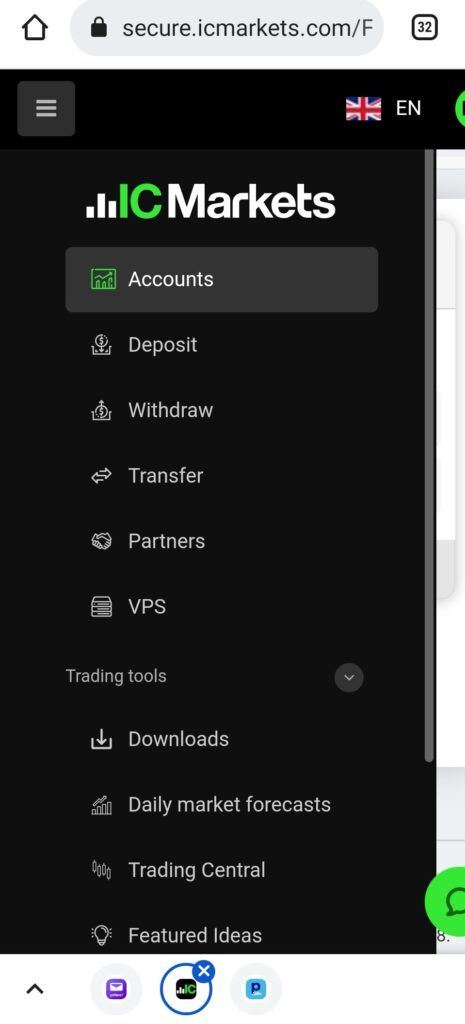

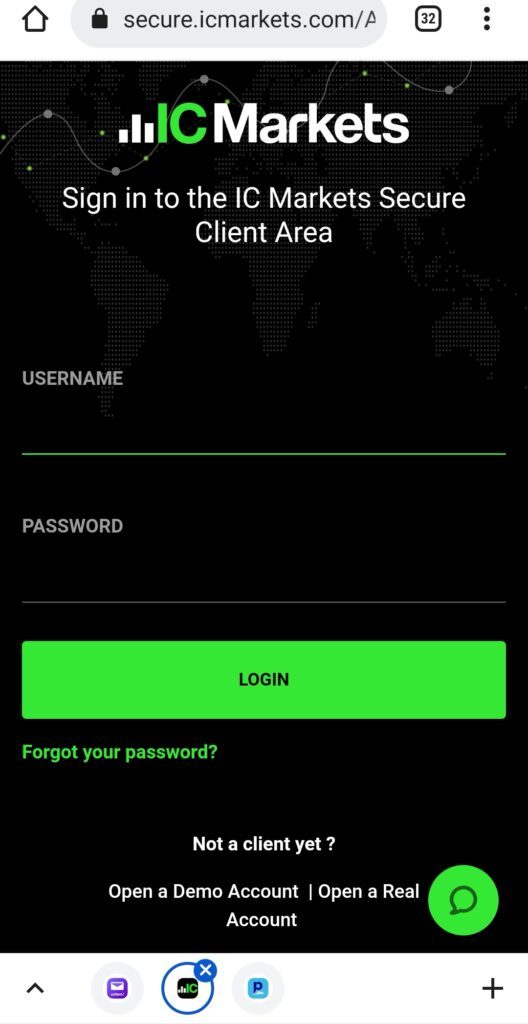

You will receive an email with your login and password to a secure client area. This is where you can manage your personal information, deposits, and withdrawals.

You have to provide a valid identification document (Identity card, passport, or driving license) and proof of residence (utility bill or bank statement). You can upload these documents online in your secure client area.

If your documents are in order and have not expired, your account will be approved the next day.

The following screenshots are taken on an Android phone. You can access both IC Markets and MT4 from your phone.

Funding Your Account and Withdrawing Money with IC Markets

IC Markets requires a minimum deposit of 200 USD.

You can use credit or debit cards, international bank transfers (fees may apply), PayPal, Skrill, etc.

PayPal / Neteller / Skrill is the fastest way to withdraw money. The withdrawal is instant. Use the same method and account from where you initially deposited the money.

Credit cards are the 2nd best method to fund your account or withdraw money, however, this is not available for every country. Once your card is approved, deposits are instant. Withdrawals to credit cards take about 3-5 days to be transferred, sometimes more and sometimes less.

You should only use cards issued in your name.

International bank transfer is another option but fees may apply.

Bank wire transfers are possible but incur a fee of AUD20.

How to Connect IC Markets to MT4

The video below shows you how to access IC Markets on MetaTrader 4. First, you need to download the MT4, and then access the IC Markets live server as instructed by email.

On the IC Markets website, you will find video tutorials on how to log in to CTRADER and how to navigate onto MT4 or MT5, both on the web trader and the App.

Does IC Markets allow Scalping?

IC Markets has no restrictions and permits different trading styles, including Scalping, Hedging, and automated trading.

PROS & CONS At a Glance

PROS of IC Markets

- You can trade from anywhere using any device (web trader, IOS, and Android)

- Fast account opening.

- Start trading with as little as 200 USD.

- Accept deposits in 10 major currencies.

- Various ways to deposit and withdraw money.

- No fees are charged for deposits and withdrawals. You may incur fees from international banks depending on where you live.

- Flexible leverage options up to 1:500.

- 24/7 Support (by chat or email).

- Free Demo Account.

- Lower possible spreads.

- Raw Spread account spreads start from 0.0 pips.

- Low spreads on other accounts.

- Scalping, hedging, and automated trading are all allowed.

- Excellent customer support.

- Regulated by; ASIC (Australian Securities and Investment Commission) meeting strict capital requirements.

- Transparency, no price manipulation.

- No inactivity fee if you stop trading with IC Markets.

Cons of IC Markets

- Accounts registered in Australia and Europe can no longer have leverages higher than 1:30. If you want higher leverage up to 1:500 you need to transfer your account to Seychelles.

Learn Forex Trading with IC Markets

IC Markets has a dedicated team of expert traders that give educational live tutorials for FREE. Isn’t that insane? You can register for the live webinars here. There are webinars for all levels, beginners, and more advanced traders.

Can IC Markets Be Trusted

The answer is definitely, YES, IC Markets can be trusted. I have been with IC Markets since 2019. I can highly recommend them as the customer support is excellent. The team is knowledgeable, responds quickly, and resolves promptly. IC Markets are also very efficient when it comes to withdrawals.

This is how customers rate IC Markets

IC Markets has hit an all-time high with over 17,500 reviews on Trustpilot!

IC Markets Team

IC Markets Tech Support

If you have a query you can contact support via email (support@icmarkets.com). Emails are answered within 24 hours.

Alternatively, you can use the chat service accessed from your Client’s Secure Area. A chatbot will take your query and suggest a solution. If it is not solved you are immediately connected to a real person. The support team is knowledgeable and usually, the consultants come back with a solution straight away.

People describe IC Markets support as helpful, fast, efficient, and reliable. Read the reviews here.

My Verdict

I discovered IC Markets through a friend, and I am forever grateful as I did not have to do any research about the broker since I trust this friend who has been trading with IC Markets for a while.

Signing up was an easy task and I got approval the next day. Funding is possible in various ways and withdrawing money is processed quickly. To date, I never had any issues, the reason why I recommend IC Markets broker without hesitation.

Conclusion

In this review, I share information about IC Markets which is one of the world´s largest online foreign exchange brokers.

IC Markets is a legit broker regulated by entities in Australia, Cyprus, and Seychelles.

There are no restrictions on trading styles and scalping is permitted with IC Markets.

You can set and change the leverage yourself in your secure clients´ area for up to 1:500.

The IC Markets broker minimum deposit is $200.

IC Markets operates on MT4, MT5, and CTRADER platforms. Opening a demo or live account is easy and the support service team is prompt, friendly, and knowledgeable.

Why don’t you check them out?